Hay sheds are beneficial infrastructure and smart investments for both livestock and cropping enterprises.

The benefits of hay storage sheds can provide are well known. For example, maintaining hay quality and increasing market value. Or allowing you to buy hay at lower prices ahead of time to help drought-proof your farm.

There are other advantages too. A hay shed is a versatile asset and can also be a tax deduction.

Understanding payoff periods and ROI is important though – knowing the numbers and how they stack up can help you make good financial decisions when project planning and budgeting.

In this article we cover payback timeframes for hay sheds, hay shed return on investment and provide handy examples and resources.

What is Asset Payback? How Is It Calculated?

The asset payback period refers to the amount of time it takes to recover the initial cost of the asset – similar to a break-even analysis.

Payback is usually expressed in years and helps you evaluate the cost-effectiveness, risks and opportunities of an asset.

Asset payback is usually calculated by simply dividing the initial investment cost by the payback over a set time e.g. a year.

HAY SHED PAYBACK = Cost Of Hay Shed / Payback In A Year

Next up, is an overview of the different factors that can influence the payback period of a hay shed – and then we provide examples of how this formula can be used to determine how cost-effective a hay shed is and how quickly a hay shed can be paid off.

Factors That Influence Hay Shed Pay Off Period

Here is a summary of the main factors that influence the payback period for a hay shed, from hay shed configuration to market prices.

Keep in mind that the factors can differ between livestock and cropping operations.

- The overall cost of the hay shed project (shed kit, installation and any permits required)

- Cost-effectiveness of the hay shed size and design (such as cost-per-bale and versatility)

- Money saved by being able to buy hay in bulk at lower prices and store on-farm

- Money saved by using the hay shed project as a tax deduction. Keep in mind, the method chosen to purchase your new shed (for example, lease, chattel mortgage or cash) may impact the tax deduction you will be able to receive.

- Revenue gained by maintaining hay quality and selling hay later when prices rise.

- Revenue gained by feeding livestock quality hay and keeping them in good condition.

- Seasonal and market conditions such as supply and demand dictating hay prices.

The examples below show how some of these factors can come into play.

First up is an example of how quickly a primary producer can pay off their new hay shed.

Disclaimer:

Please note that these examples are general only and do not constitute financial advice. Any information such as tax rates or hay prices are not necessarily current and are used as a guide only. Check with your accountant on specific details and how this could be used in your situation.

Example – How Quickly Can A Livestock Producer Pay Off A Hay Shed?

- In July, dairy farmer Dan from Dan’s Dairy Pty Ltd builds a 1,000-bale hay shed for $100,000. For example, the standard 32m x 18m x 6m hay shed.

- Dan buys 1,000 square bales at $180/bale or around $290/tonne to feed his cows for a total outlay of $180,000.

- By December, the price for hay has increased to $220/bale or around $350/tonne. By buying his hay earlier when supply was up and prices were down, Dan has saved around $40,000.

- When June 30 comes around, as a primary producer using the hay shed to store fodder for livestock, Dan can use the new hay shed as a tax deduction:

- Dan’s Dairy Pty Ltd has a taxable income of $500,000 and without any deductions would pay around $125,000 in tax, based on a company tax rate of 25%.

- Using his hay shed as a tax deduction, Dan can reduce the taxable income to $400,000 and would pay around $100,0000 in tax. As a result, Dan would save around $25,000 in tax.

Overall, Dan has saved $65,000 which means he has paid off 65% of his $100,000 hay shed in the first year.

We have calculated the payback period for the full amount below:

$100,000 (cost of hay shed) / $65,000 (payback in year 1) = 1.53 years before the shed is paid off in full.

And, if the seasonal conditions were favourable (i.e. good pasture or silage production), Dan could sell some of his hay at the higher market price to areas that weren’t so favorable. This would reduce the payback period further.

Next up, let’s look at how this can work for a hay grower.

Example – How Quickly Can A Hay Grower Pay Off A Hay Shed?

- In January, hay grower Harry builds a hay shed to store 3,600 hay bales from the 2024 harvest. He spends around $250,000 on a standard size hay shed, such as the 64m x 24m x 7.5m hay shed.

- The current market price for hay is around $180/bale or around $290/tonne, so Harry is storing around $648,000 worth of hay.

- By October supply is down and the price for shedded hay has increased, and Harry sells his hay for $220/bale or around $350/tonne for a total revenue amount of $792,000.

As a result, Harry receives about $144,000 more for his hay.

We have calculated the payback period for the shed below:

$250,000 (cost of hay shed) / $144,000 (payback in year 1) = 1.73 years before the shed is paid off in full.

This does not take into account depreciation or tax deductions Harry may be able to take advantage of.

What Else Do You Need To Know About Paying Off A Hay Shed?

One thing to keep in mind when it comes to paying off your hay shed, is how cost-effective your hay shed design is.

A cost-effective hay shed design will reduce the cost/bale for storage and shorten the payback period.

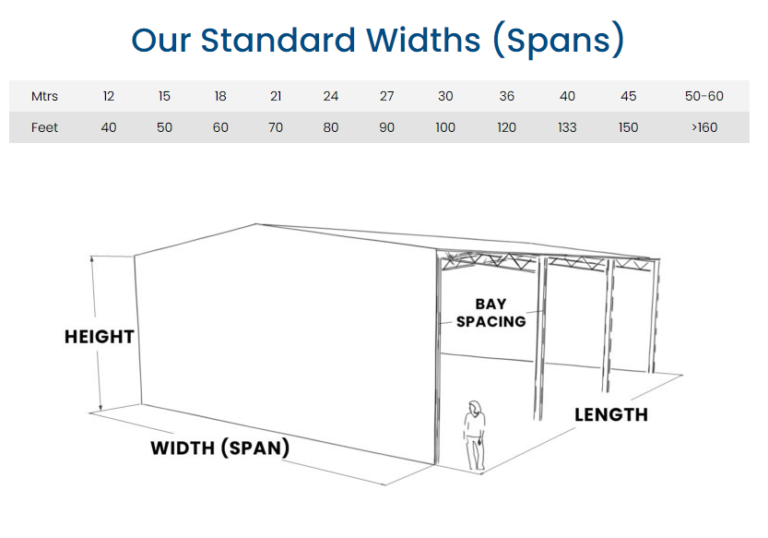

There are several ways to achieve a lower cost/bale with your hay shed design. These include choosing a longer configuration rather than a wider configuration.

Increasing the height of your shed is another cost-effective way to fit more bales in – provided it is safe to do so.

Or you could also consider including a cantilevered canopy. Including a canopy is usually more cost-effective than using the shed span. For example, a 24-metre span shed with a 6-metre canopy will cost less than a 30 metre span shed.

However, a canopy is usually best used as a temporary storage area.

Finally, you could consider creating a versatile hay shed design to get the best value for your money. For example, a hay shed design that also works for machinery storage.

Cost-Effective Hay Shed Inspiration Gallery

Next up we look at another great tool for asset management and investment decisions – calculating the return on investment.

What Is ROI? How Is It Different To Asset Payback? How Is It Calculated?

Return on investment, also commonly known as ROI, measures how much money you make from an investment.

While the payback period is a time frame, ROI is usually expressed as a percentage.

Calculating ROI helps you determine how effective your asset is and where to direct your investment in the future.

This is calculated by using this formula:

HAY SHED ROI = Total Revenue and/or Savings / Initial Investment x 100%

Factors That Influence The Return On Investment Of A Hay Shed

Like the payback period of a hay shed, there are factors that influence the ROI of a hay shed.

These include the project costs, cost savings, tax deductions and extra revenue gained.

Below, we’ve used the examples of dairy farmer Dan and hay grower Harry to show how ROI is calculated.

Example – Hay Shed ROI For Livestock Producers

Dairy farmer Dan builds a $100,000 shed and saves $40,0000 in hay costs and $25,000 in tax payments.

$65,000 (total savings) / $100,000 (cost of hay shed) = 0.65

x 100% = 65% ROI

Example – Hay Shed ROI For Hay Growers

Hay grower Harry builds a hay shed for $250,000 and earns $144,000 in additional revenue by storing his hay in a shed.

$144,000 (extra revenue) / $250,000 (cost of hay shed) = 0.576

x 100% = 57.6% ROI

What Else Do You Need To Know About Hay Shed ROI?

Calculating the ROI and payback periods are just two ways to evaluate an investment.

Some other factors to consider when reviewing your assets – which may not be relevant to your hay shed project – include risks, maintenance costs, operating expenses, cash flow, asset life span and opportunity costs.

Useful Resources & Further Reading

That’s a wrap on hay shed pay back and ROI. We trust we have answered all your questions such as How quickly can I pay off my shed? What is the ROI of a hay shed?

Here are some additional resources to help you with your project planning and budgeting:

- Farm Shed Tax Write-Off In 2024

- How To Budget For Your New Farm Shed

- 7 Best-Practice Hay Shed Design Ideas

- Featured Project – Versatile Hay Shed With Concrete Panels

For more information and resources, browse the Learning Hub. Or for pricing for your hay shed project, call us on 1800 687 888 or submit a REQUEST A QUOTE form.

Disclaimer: Please note that these examples are general only and do not constitute financial advice. Any information such as tax rates or hay prices are not necessarily current and are used as a guide only. Check with your accountant on specific details and how this could be used in your situation.